Is Your At-Home Sleep Study Covered by Insurance?

You have noticed the signs. Waking up exhausted despite a full night in bed. Your partner mentions the snoring, the gasping, the moments when you seem to stop breathing entirely. You suspect sleep apnea might be the culprit, but you don’t know if your at-home sleep study is covered by insurance.

Dr. Avinesh Bhar, CEO of SLIIIP and someone who also suffers from sleep apnea, shares his thoughts on how insurance views sleep studies. He and his team of board-certified sleep doctors have helped over 10,000 patients in 40 states sleep better.

This guide breaks down coverage by insurance type, explains what you will pay out of pocket, and provides practical steps to maximize your chances of approval.

The Short Answer: Yes, Most Insurance Covers Home Sleep Tests

Medicare, Medicaid, and most private insurance plans cover at-home sleep apnea tests when a doctor determines the test is medically necessary. Coverage typically requires documented symptoms of sleep apnea and a physician’s order. The specific amount you pay depends on your plan type, deductible status, and whether you use an in-network provider.

If you feel you may have an issue with sleep apnea and want a home sleep test. SLIIIP has a team of sleep doctors that can assist you.

We accept Medicare, Tricare and most major insurances.

Home sleep tests generally cost significantly less than in-lab polysomnography, which is one reason insurance companies often prefer them as a first-line diagnostic tool for suspected obstructive sleep apnea. While an in-lab study can cost $1,000 to $3,000 or more, home sleep tests typically range from $150 to $500, making them a cost-effective option for both insurers and patients.

Medicare Coverage for Home Sleep Studies

Medicare Part B covers Type II, III, and IV home sleep tests when you show clinical signs and symptoms of obstructive sleep apnea. To qualify for coverage, you must meet specific criteria established by the Centers for Medicare and Medicaid Services.

Your doctor must order the test based on documented symptoms such as loud snoring, witnessed breathing pauses during sleep, excessive daytime sleepiness, morning headaches, or waking up gasping or choking. Medical records should support the clinical suspicion of sleep apnea before Medicare will approve coverage.

After you meet your Part B deductible, Medicare pays 80% of the Medicare-approved amount for the home sleep study. You are responsible for the remaining 20%. For example, if the Medicare-approved amount for your home sleep test is $200, you would pay $40 after meeting your deductible.

Medicare does not require prior authorization for home sleep studies in most cases, but the test must be ordered by your physician and must be deemed medically necessary. The provider performing the test must accept Medicare assignment for you to receive the standard coverage rates.

If your home sleep test confirms obstructive sleep apnea, Medicare also covers CPAP therapy during a three-month trial period. Continued CPAP coverage requires documentation that therapy is helping, typically defined as using the machine for at least four hours per night on 70% of nights.

Medicaid Coverage for Home Sleep Tests

Medicaid covers home sleep studies in most states, though specific coverage criteria vary by state. Generally, Medicaid requires symptoms of a sleep disorder and physician documentation supporting the need for testing.

SLIIIP does accept Medicaid insurance for its home sleep tests and sleep treatment.

You can book an appointment here

Coverage has expanded in recent years. For example, New York State Medicaid began covering home sleep tests in December 2024 for members who would experience difficulty traveling to a sleep lab due to mobility issues. Other states have similar provisions that make home testing accessible to those who cannot easily reach an in-lab facility.

Out-of-pocket costs under Medicaid are typically minimal, often involving small copayments based on income. Many Medicaid recipients pay nothing beyond their usual copay for the home sleep study itself.

To determine your specific Medicaid coverage, contact your state Medicaid office or your managed care plan directly. Coverage criteria can change, and understanding your state’s requirements before testing ensures you avoid unexpected costs.

Private Insurance Coverage

Private insurance plans from major carriers including Blue Cross Blue Shield, Aetna, Cigna, United Healthcare, and others generally cover home sleep apnea tests when medically necessary. However, private insurance typically involves more requirements than Medicare or Medicaid.

Most private insurers require prior authorization before approving a home sleep study. This means your doctor must submit documentation to your insurance company explaining why the test is medically necessary. The authorization request typically includes your medical history, documented symptoms, physical exam findings, and any relevant risk factors.

Common documentation requirements may include:

- Body mass index (BMI)

- Neck circumference

- History of snoring

- Pauses in breathing during sleep reported by a bed partner

- Epworth Sleepiness Scale score (measures daytime sleepiness)

- How long symptoms have been present

Insurance plan requirements:

- HMO plans: Usually require a referral from your primary care provider before seeing a sleep specialist or completing a sleep study

- PPO plans: Typically do not require a referral, but may still need prior authorization for the sleep test

Provider network considerations:

- Using an in-network provider usually lowers out-of-pocket costs

- In-network providers have negotiated rates, so you pay only your copay or coinsurance

- Out-of-network testing may cost significantly more or may not be covered at all

Ready to Get Tested?

At Sliiip, we handle insurance verification and prior authorization for you. Our team works directly with your insurance company to maximize your coverage.

Choose the option that fits your situation:

- Home Sleep Test with Prescription (if you already have a prescription)

- Home Sleep Test + Prescription (includes telemedicine consultation)

- Sleep Assessment Only (evaluation to determine if testing is right for you)

Book a Free Consultation | Call Us: 478-238-3552

What You Will Pay Out of Pocket?

Your actual cost for a home sleep study depends on several factors: your insurance type, whether you have met your deductible, your copay or coinsurance percentage, and whether you use an in-network provider.

Insurance Type | Typical Out-of-Pocket Cost |

Medicare | 20% after deductible ($30-$60) |

Medicaid | Minimal copay or $0 |

Private Insurance (in-network) | $20-$70 copay or 10-30% coinsurance |

Private Insurance (deductible not met) | $150-$500 |

Self-Pay | $150-$600 |

With Medicare, you pay 20% of the Medicare-approved amount after meeting your Part B deductible. If the approved amount is $200, your cost is $40.

With private insurance, costs vary widely. If you have met your deductible and use an in-network provider, you might pay a copay of $20 to $70 or coinsurance of 10% to 30% of the allowed amount. If you have not met your deductible, you may pay the full cost up to the negotiated rate, which could range from $150 to $500 for a home sleep test.

Without insurance, home sleep tests typically cost $150 to $600 depending on the provider and what services are included. Some direct-to-consumer sleep testing services offer self-pay rates around $200 to $300 that include the test, physician interpretation, and follow-up consultation.

For comparison, in-lab polysomnography without insurance ranges from $1,000 to $3,000 or more. Even with insurance, in-lab studies typically cost more out of pocket than home tests due to facility fees and the comprehensive nature of the testing.

Using HSA and FSA Funds

Health Savings Account and Flexible Spending Account funds can be used to pay for home sleep apnea tests. These pre-tax dollars effectively reduce your cost by 20% to 30% depending on your tax bracket.

Sleep studies qualify as eligible medical expenses under IRS guidelines because they are diagnostic tests ordered by a physician to identify a medical condition. The same applies to CPAP machines, masks, and other sleep apnea treatment equipment if you are diagnosed with the condition.

Some FSA and HSA debit cards work directly for medical purchases, while others require you to pay out of pocket and submit receipts for reimbursement. Check with your plan administrator about how to use your funds for sleep testing services.

If you have FSA funds that expire at year end, using them for a needed sleep study ensures you do not lose the money while addressing a potential health issue. HSA funds roll over year to year, so timing is less critical, but using pre-tax dollars still provides meaningful savings.

Steps to Get Your Home Sleep Test Approved

Maximizing your chances of insurance approval requires preparation before you request testing. Following these steps can streamline the process and reduce delays.

Step 1: Document Your Symptoms

Keep a sleep diary noting when you go to bed, when you wake up, how often you wake during the night, and how you feel in the morning. Record snoring observations from your bed partner, any gasping or choking episodes they witness, and your level of daytime fatigue. This documentation supports the medical necessity of testing.

Step 2: Schedule a Consultation with SLIIIP

Schedule an appointment with a sleep specialist from SLIIIP. The physician will evaluate your medical history and schedule a home sleep test.

Step 3: Verify Insurance Benefits

SLIIIP will verify your insurance benefits before ordering the test. The office staff can contact your insurance company to confirm coverage, check whether prior authorization is required, and identify any in-network testing providers. This verification step prevents surprises about coverage or costs.

Let Us Handle the Paperwork

Navigating insurance authorization can be frustrating. At Sliiip, our dedicated team handles the entire process:

✓ Insurance verification before your appointment

✓ Prior authorization submission

✓ Direct billing to your insurance

✓ Clear explanation of your costs upfront

Book a Free Consultation to get started.

What If Your Insurance Denies Coverage

Insurance denials for home sleep tests are relatively uncommon when proper documentation is submitted, but they do occur. Understanding why denials happen and how to appeal them protects your ability to get diagnosed.

Possible reasons for denial:

- ☐ Not enough documentation of symptoms

- ☐ Prior authorization was missing

- ☐ An out-of-network provider was used without approval

- ☐ Insurance determined an in-lab sleep study is required instead of a home test

If your claim is denied:

- ☐ Request a written explanation of the denial from your insurance company

- ☐ Review the specific reason given to guide next steps

If denial is due to missing or insufficient documentation:

- ☐ Work with your doctor to submit additional medical information

- ☐ Include detailed symptom history and exam findings

- ☐ Add a letter explaining why a home sleep test is appropriate

If prior authorization was not obtained:

- ☐ Ask if a retroactive authorization request is allowed

- ☐ Contact your insurance company to confirm eligibility

Appeal options:

- ☐ Confirm how many appeal levels your plan allows

- ☐ Request a peer-to-peer review between your doctor and the insurance medical reviewer

If appeals are unsuccessful:

- ☐ File a complaint with your state insurance commissioner

- ☐ Request an external review of the denial

Home Sleep Test vs In-Lab Study: Insurance Preferences

Insurance companies generally prefer home sleep tests over in-lab polysomnography for initial sleep apnea diagnosis because home tests cost significantly less. Many insurers require a home sleep test as the first step before approving an in-lab study.

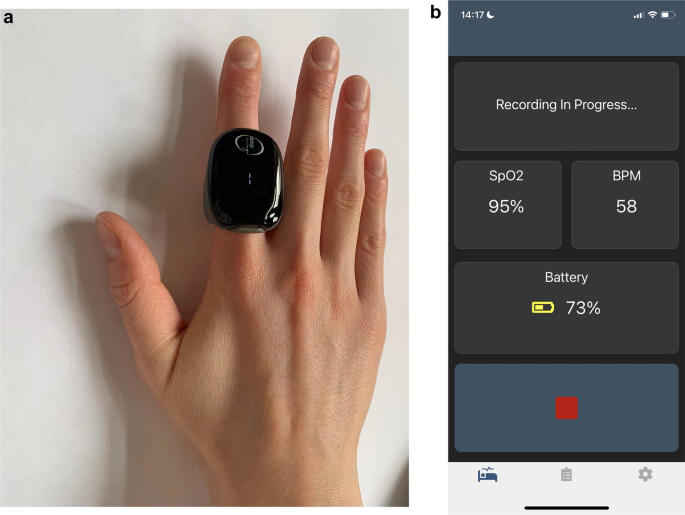

Home sleep tests are appropriate for most adults with suspected obstructive sleep apnea who do not have significant comorbidities. They measure breathing patterns, blood oxygen levels, heart rate, and airflow to determine whether you have sleep apnea and how severe it is.

In-lab polysomnography may be required instead of a home test if you have certain conditions including heart failure, chronic obstructive pulmonary disease, neuromuscular disease, or if a sleep disorder other than obstructive sleep apnea is suspected. Central sleep apnea, narcolepsy, and parasomnias generally require in-lab testing for accurate diagnosis.

If your home sleep test results are inconclusive or negative despite strong clinical suspicion of sleep apnea, your doctor may order an in-lab study as a follow-up. Insurance typically covers this second test when the first was insufficient for diagnosis.

Understanding your insurer’s preferences helps you navigate the diagnostic process efficiently. If your insurance requires trying a home test first, completing that step allows you to proceed to in-lab testing if needed without coverage disputes.

Coverage for Treatment After Diagnosis

A positive sleep apnea diagnosis from your home sleep test opens the door to treatment coverage. Understanding what comes next helps you plan financially and ensures continuous care.

CPAP Therapy

CPAP therapy is the most common treatment for obstructive sleep apnea, and most insurance plans cover CPAP machines and supplies when prescribed following a qualifying sleep study. Medicare covers 80% of the CPAP cost after deductible, while private insurance coverage varies by plan.

Insurance companies typically require compliance monitoring during the first months of CPAP therapy. Medicare requires use of at least four hours per night on 70% of nights during the initial 90-day period. Similar requirements apply with many private insurers. Demonstrating compliance ensures continued coverage for your CPAP equipment and supplies.

Oral Appliances

Oral appliances represent an alternative to CPAP for some patients with mild to moderate sleep apnea. Insurance coverage for oral appliances varies more widely than CPAP coverage. Many plans require documentation that CPAP was tried and failed before approving oral appliance therapy.

The myTAP Precision Fit Oral Appliance offers an accessible option for those exploring alternatives to CPAP. This custom-fit device positions your jaw to keep your airway open during sleep.

Follow-Up Studies

Follow-up sleep studies to assess treatment effectiveness are generally covered when medically necessary. These might be ordered if your symptoms persist despite therapy, if you experience significant weight changes, or if treatment settings need adjustment.

Diagnosed with Sleep Apnea? Explore Your Treatment Options

At Sliiip, we offer multiple treatment pathways based on your needs:

CPAP Therapy:

- Transcend Micro Travel CPAP + FREE Mask

- Transcend Micro Power Bundle

- AirMini with P10 Mask Pack

- AirMini with N20 Mask Pack

- AirMini with N30 Mask Pack

CPAP Alternative:

Book a Treatment Consultation to discuss which option is right for you.

When to Consider Self-Pay

In some situations, paying out of pocket for a home sleep test makes sense even if you have insurance.

If you have a high-deductible health plan and have not met your deductible, the negotiated insurance rate for a home sleep test might be similar to or higher than self-pay prices offered by direct-to-consumer testing services. Comparing your insurance cost against self-pay options helps you make an informed decision.

Self-pay eliminates the prior authorization process, allowing faster access to testing. If you need results quickly for work, travel, or commercial driver licensing requirements, paying out of pocket might be worth the convenience.

Money spent on self-pay medical services including home sleep tests can count toward your insurance deductible for future healthcare needs. Save your receipts and ask your insurance company about submitting them for deductible credit.

Self-pay costs for home sleep tests typically range from $150 to $300 when the test includes physician interpretation and follow-up consultation. Some services charge additional fees for prescription services or treatment equipment if you are diagnosed with sleep apnea.

The Bottom Line

At-home sleep studies are covered by Medicare, Medicaid, and most private insurance plans when medically necessary. Coverage requires documented symptoms, a physician’s order, and often prior authorization from your insurance company. Out-of-pocket costs depend on your specific plan, deductible status, and provider choice.

Taking time to understand your coverage, document your symptoms, and work with your healthcare provider on proper authorization increases your chances of approval while minimizing unexpected costs. The investment in proper diagnosis opens the door to treatment that can dramatically improve your sleep quality, daytime energy, and long-term health.

If you are experiencing signs of sleep apnea such as loud snoring, gasping during sleep, morning headaches, or excessive daytime fatigue, talk to your doctor about whether a home sleep study is appropriate for you. With proper preparation, insurance coverage for testing is usually straightforward to obtain.

Take the First Step Today

Stop wondering if you have sleep apnea. Our board-certified sleep specialists can evaluate your symptoms, verify your insurance coverage, and get you tested from the comfort of your home.

Book a Free Consultation | Email: info@sliiip.com | Call: 478-238-3552

Home Sleep Test Options:

Insurance accepted. HSA/FSA eligible. Results in days, not weeks.

Latest posts

-

Best Mandibular Advancement Devices for Sleep Apnea

You have been diagnosed with sleep apnea, but the thought of sleeping connected to a CPAP machine every night feels overwhelming. Perhaps you tried CPAP and found it uncomfortable, noisy,…

-

Transcend Micro CPAP Review: Is This Portable CPAP Worth It?

Imagine fitting your entire CPAP setup into something smaller than a softball. Dr. Avinesh Bhar, CEO of SLIIIP and someone who also suffers from sleep apnea, shares his thoughts on…

·

Get updates

Spam-free subscription, we guarantee. This is just a friendly ping when new content is out.